When you transfer money online through Google Pay, sometimes payments take time to reflect, or you may need proof that your money actually reached the receiver. That’s when the UTR number becomes important. This unique code helps you track, confirm, or resolve your financial transaction - whether it’s an NEFT, RTGS, or UPI payment.

UTR Number in GPay

A UTR (Unique Transaction Reference) number is typically a 16- or 22-character alphanumeric code, depending on whether the specific transaction is processed via NEFT or RTGS. It’s like a digital receipt number that identifies your transaction in the banking network and represents the meaning of UTR number used across all Indian banks.

Importance of UTR Numbers for Digital Payments

Here’s why it matters:

Proof of Payment

It serves as a reliable confirmation that your transaction was processed successfully and can be used to verify payments to third parties.

Tracking Delays

If a payment is in process for an unusual amount of time, the UTR helps your bank locate and resolve the issue instantly.

Refunds & Reversals

Banks use the unique UTR number to trace and return failed payments, ensuring that funds are correctly reversed to the sender's account.

Record Keeping

It serves as a permanent reference for financial audits, bank reconciliations, and official tax documentation.

Without a UTR number, resolving payment issues would be nearly impossible.

Understanding UTR Number in Google Pay

When you send money through Google Pay, you’re not actually sending funds from Google’s system. The mobile banking app acts as a bridge to your bank account through UPI (Unified Payments Interface), which is linked to your UPI ID in Google Pay.

Each time you make a payment:

Payment Request

Google Pay sends the request to your bank to initiate the transaction process.

Bank Processing

Your bank processes the payment through various protocols such as UPI, NEFT, or RTGS.

UTR Generation

The bank generates a UTR (Unique Transaction Reference) number to uniquely mark that transaction in the financial system.

Transaction Display

Google Pay may show the UTR number for NEFT/RTGS payments, while UPI transfers typically display a separate UPI transaction ID.

This is why your UTR number is linked to your bank, not Google Pay itself. Google Pay simply retrieves and displays it for you.

Track UTR Number in GPay vs Other Banking Apps

For NEFT or RTGS payments, the UTR shown in Google Pay (if available) matches the one in your bank app. However, for UPI payments, Google Pay may display a UPI reference number instead. Since the UTR is generated by your bank (not by Google Pay), it remains identical across all platforms where the transaction appears.

- In Google Pay, the UTR code appears in every transaction details under “Payment Info.”

- In your bank’s app or statement, it appears under “Reference Number” or “Transaction ID.”

How UTR Number Is Used in UPI Payments and RTGS Transfers

UTR numbers are a common feature across all digital payment systems, but their format and function can vary depending on whether the transaction is made through UPI, NEFT or RTGS.

UTR Number in UPI Transactions

When you make a UPI transfer, the system generates a unique UPI Reference Number (sometimes referred to as a UTR in apps, but technically distinct from the bank-generated UTR used for NEFT or RTGS). This code is used to track the transaction within the UPI network and is processed almost instantly, as UPI payments occur in real time.

Forget Manual UTR Verification

UTR Number in RTGS Transactions

For larger payments (usually above ₹2 lakh), Google Pay routes the transaction through your bank’s RTGS system - RTGS stands for Real Time Gross Settlement - which is used for high-value fund transfers between banks. RTGS UTR numbers are usually 22 characters long and often include a bank identifier (such as part of the IFSC code) at the start.

RTGS UTRs are critical for business payments or fund transfers involving higher amounts since banks use them to trace payments across interbank networks.

How to Find UTR Number in Google Pay

Finding your UTR number in Google Pay is easier than it might seem - you just need to know where to look.

Whether you’re checking the status of a recent transfer, confirming that a payment reached the receiver, or resolving a failed transaction, the UTR number is available right inside your Google Pay history.

You don’t need to visit your bank or download a statement - the app keeps this information neatly organized under each payment.

Where to Find the UTR Number in GPay App

Open the App

Launch the Google Pay app on your mobile device.

Access History

Scroll down and tap on the “Show transaction history” option to see your past payments.

Select Transaction

Find and select the specific payment you want to check for more details.

View Details

Scroll down within the transaction screen and tap on “View Details” to expand the information.

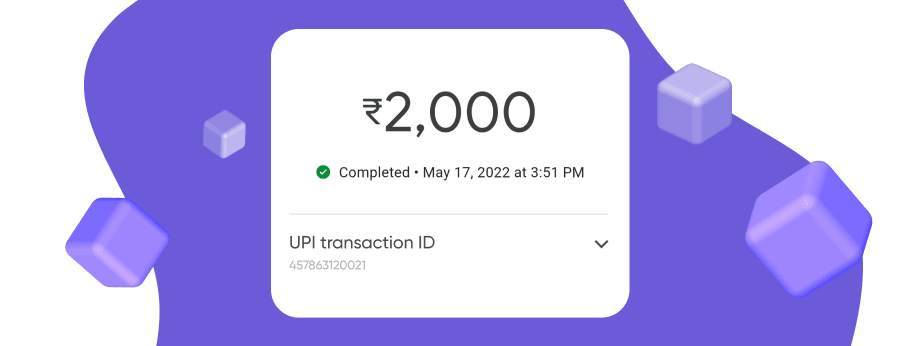

Identify Reference IDs

Search for ‘UPI Transaction ID’ or ‘Bank Reference ID’. Note that while Google Pay labels these, the official bank UTR typically appears in your bank statement.

But remember, this might not be the official UTR. The actual UTR, which banks use to settle transactions between each other, might be different and is usually located in your bank statement, online banking platform, or through SMS notifications.

How to Check UTR Number Online

If you can’t find it in the GPay app, you can also check:

- Bank mobile app: Open your transaction history and tap on the payment to see the UTR.

- Net banking account: Go to your transfer history or mini statement section.

- Email/SMS alerts: Most banks send the UTR number when confirming your transaction.

Finding Your UTR in a Bank Statement

If your transaction happened a few days ago, the easiest way to find your UTR is through your bank statement.

Log in to Net Banking

Log in to your bank’s official net banking portal using your secure credentials.

Open Account Statement

Navigate to the statements section and open your account statement for the relevant date range.

Locate Reference Columns

Look under columns specifically labeled as “Ref. No.”, “UTR No.”, or “Transaction ID.”

Note the UTR Number

Identify and note the unique number next to your specific Google Pay transaction record.

You can also download the statement as a PDF and search for “UTR” to locate it instantly. This method is especially helpful for old transactions that may no longer appear in your Google Pay history.

What is the Process to Track Google Pay Transactions with UTR Number?

Once you have the UTR number, you can easily track your transaction to see its status.

Visit Bank Website or App

Visit your bank’s official website or open their mobile banking app on your device.

Navigate to Tracking

Go to the “Track Transaction” or “Payment Enquiry” section within the banking interface.

Enter Transaction Data

Enter the UTR number and the specific transaction date into the required fields.

Check Status

The system will display the real-time status, showing whether the payment is Successful, Pending, or Failed.

If the transfer is stuck, share the UTR number with your bank’s support team or customer care.

UTR Number Example from a Bank Statement

Let’s look at a sample from an HDFC Bank statement:

| Date | Description | Amount | Ref/UTR No. |

|---|---|---|---|

| 15 Oct 2025 | GPay Transfer to RAMESH | ₹2,500 | HDFCR 231015 00012345 |

In this case:

- The transaction was made through Google Pay.

- ₹2,500 was transferred successfully.

- “HDFCR23101500012345” is the UTR number.

Conclusion

The UTR number is one of the most important details in any Google Pay transaction. Whether you’re sending money to a friend, paying a business, or confirming a large fund transfer, this unique reference code ensures your transaction can be tracked, verified, and resolved quickly.

If a payment ever seems delayed or you need proof that funds were sent, checking your UTR number in Google Pay or your bank statement is the fastest way to find answers. It serves as your digital fingerprint in the banking system - the one number that ties your transaction to the bank’s network and confirms exactly where your money is.

Gain full control over your transactions with enterprise-level payment tracking

Online Payment Company #1

Online payment solutions for all types of businesses since 2019

Subscribe to stay updated

on industry news, insights, and exclusive offers